The budget for 2023 was anticipated with great interest by startups and smaller businesses operating in today’s market. In my opinion, the budget had numerous encouraging measures that will benefit new enterprises. This article will provide information on my analysis on DigiLockers and how they relate to the highlights of Budget 2023 and how they will affect MSMEs.

Everything You Need to Know About a DigiLocker

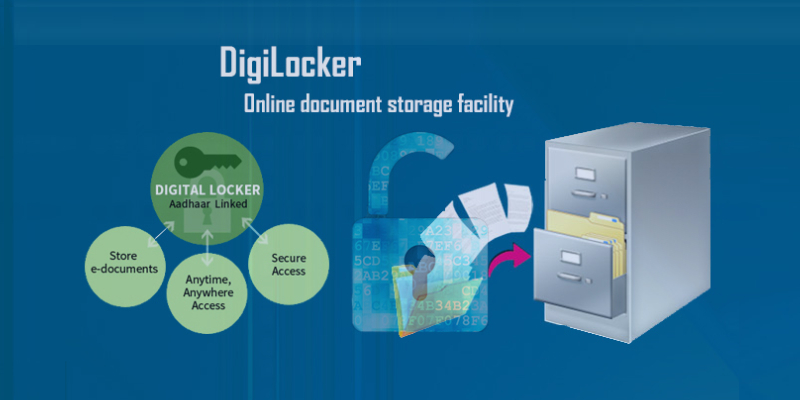

The government’s goal with DigiLocker is to make paperless administration effective. The DigiLocker gives you access to a document wallet that is totally digital. The goal is to make it easier for people and businesses to securely store, distribute, and validate certificates and other forms of identification. DigiLockers are similar to traditional lockers, and they are used to hold digital copies of crucial papers like PAN cards, AADHAR cards, and other government-issued IDs.

Procedure to create a DigiLocker

- Click the sign-up button on the official website (https://digilocker.gov.in/).

- DigiLocker activation requires a valid mobile phone number as a second form of identification.

- Finish the registration process by following the on-screen instructions.

DigiLocker tutorial- How to save files

- Access the site using your credentials

- Navigate to the uploaded files section

- Upload the necessary file

- Multiple file uploads can also be done

- Choose the file to be uploaded and then click “open.”

- After uploading documents, you can designate their format

Digital Freedom – Union Budget 2023 Introduces DigiLocker Services for All

In the Union Budget 2023 speech, the Hon’ble Finance Minister Nirmala Sitharaman demonstrated the government of India’s dedication to putting technology to work for the benefit of its population. The transformation of the DigiLocker services into a robust digital document wallet was one of the most interesting developments announced.

The DigiLocker revolutionizes document management by giving individuals and organizations a safe place online to keep and share their sensitive files online. This action is a big deal for the government’s plans to digitize the entire economy and give people easier and safer access to every document. Entity DigiLocker is available to a wider range of organizations than before, including non profitable ones.

The DigiLocker infrastructure supports a “one-stop solution” for personal information held by many government departments, regulators, and regulated businesses. This would streamline the Know Your Customer (KYC) procedure, making it quicker and more convenient for customers to transact digitally and contributing to the expansion of India’s digital economy. The finance minister indicated in her speech that the Government of India is dedicated to streamlining the KYC processes.

Individuals and financial organizations will benefit greatly from DigiLocker and the decision to expand its services to the fintech sector. It gives them a safe place to keep and share information online, lessens the likelihood of losing information and facilitates faster access to vital files. By laying the groundwork for fintech innovation with DigiLocker, the finance minister hopes to spur the expansion of the digital economy and give people easier access to various financial services.

Digital public infrastructure in India, such as PM Jan Dhan Yojana, Aadhaar, Video KYC, UPI, and India Stack, have paved the way for the growth of fintech services in the country. The expansion of the DigiLocker to encompass large corporations, nonprofits, and small enterprises will provide digital governance with a much-needed boost.

Also Read: Transforming Finance With Dubai Fintech Summit 2023

Budget Announcement Propels DigiLocker’s Role. How?

The government has suggested including digital document collection under the PDI, which would significantly increase its usefulness. By streamlining and speeding up the KYC procedure, fintech firms may save money and conduct business effortlessly.

The future of how the DigiLockers should be used is still unclear. According to industry analysts, APIs should be modelled after Aadhar. APIs allow programmes to communicate with one another; thus, using them to check the authenticity of documents is a fast and easy option. However, more work is needed to guarantee the safety of these records by limiting who can access them and finding other safeguards to prevent their exploitation.

Due to the simplification of the KYC procedure, the time it takes to gain access to financing is hoped to decrease. Lowering the price of know-your-customer checks could boost productivity and enable businesses to provide more services to underserved areas of the economy.

An Overview of the Benefits of DigiLocker for MSMEs

The government’s chief financial officer has stated his intention to launch DigiLockers for micro, small, and medium-sized enterprises (MSMEs) and large corporations and nonprofits. The government has taken significant action to advance the Digital India initiative. The Unified Mobile Application for New-age Governance (UMANG), Aadhaar, and Common Services Centres are all examples of such initiatives.

The Minister of Finance has developed DigiLockers for MSMEs to give extra support to them. MSMEs, corporations, and nonprofit organizations will have access to the Entity DigiLocker, and that is in progress now. In her budget address, Finance Minister claimed this would help with “storing and sharing documents securely online, with various banks, authorities, regulators, and other business entities whenever needed”. This will unquestionably hasten the country’s progress towards its digital transformation objective.

Wrap up

I have observed that the Union Budget 2023 has established a new benchmark for digital transformation and given the DigiLocker platform a significant boost. The Entity DigiLocker revolutionizes the digital management of documents and exemplifies the Indian government’s dedication to providing its citizens and companies with easy and safe access to vital records. When I researched I found that this futuristic DigiLocker platform is helping to realize the Finance Minister’s dream of a cashless society.

Trade finance advice provides regular updates on articles related to trade finance organizations. For more articles, please visit our website.