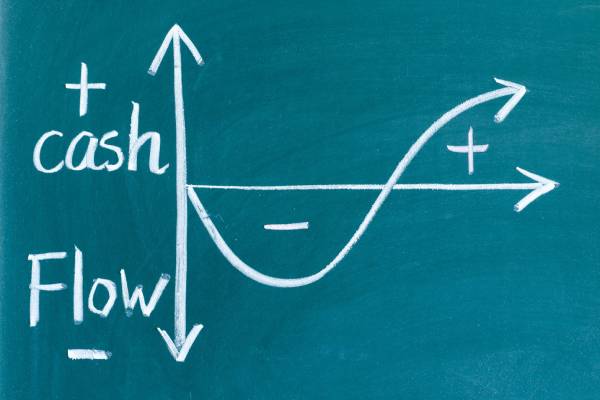

Finance management, especially cash flow, can seem to be a difficult task. But fear not, as It is vital to your triumph, guiding you through the ups and downs of economic times. Small Business Cash Flow Management is more than just monitoring your cash. It is about preparing for what lies ahead and grasping the health of your company’s finances. With forecasting as our compass, we can navigate uncertainty, equipping our businesses for whatever the weather. Let us dive into how you can manage cash flow to fortify and expand your venture.

Grasping Cash Flow in Small Businesses

Based on what I’ve seen, managing cash flow is the bedrock of a flourishing small business. It involves carefully tracking, examining, and enhancing how funds move to ensure your business can handle its financial duties. This includes settling bills, paying staff, and repaying debts. All vital for a small company’s daily grind.

In the case of small businesses, cash flow management is invaluable. It is the driving force that sustains your business. It helps you tackle the financial aspects related to running a business. I’ve seen that without solid cash flow, even the most hopeful small business might struggle to stay afloat.

Inflows and outflows are two critical elements of cash flow management. Inflows are the funds coming in, like sales income and investment returns. Outflows are the funds going out, covering costs such as buying equipment and rent.

The cash flow statement is a key player here. It lays out all the income and expenses, giving business owners a complete view of their financial situation. This document is not just for record keeping. It is a strategic tool for forecasting and planning through different economic times.

Effectively managing cash flow shows a business skill in adapting and thriving under various economic conditions.

Role of Cash Flow During Economic Cycles

From what I’ve observed, cash flow is critical for the growth of a small business, especially during the fluctuations of economic cycles. Handling cash flow well means you can manage your inventory smartly, ensuring it sells quickly and frees up cash for other parts of your business.

Improving how you manage receivables is vital. By using intelligent systems, small businesses can speed up debt collection, which enhances their cash position. Likewise, handling accounts payable strategically helps keep liquidity in check, which is essential for everyday running and future growth chances.

In my view, focusing on these aspects can significantly boost a business’s financial stability. The perks of good management are not just about staying afloat. They enable decisions that can drive a business ahead in any economic situation. As we think about the need for readily available cash, It is clear that being proactive in managing money is critical for small business owners.

Better Inventory and Receivables for Improved Cash Flow

From my experience, the link between how fast inventory sells and cash flow is crucial for small companies. To highlight the importance of managing inventory and receivables for better cash flow, let us look at these critical points:

- Intelligent inventory control can lead to significant cash flow improvements.

- Using intelligent systems to speed up collecting payments boosts cash flow.

- Fine-tuning both inventory and receivables is critical for cash flow management.

By paying close attention to these crucial areas, small business owners can ensure they have the cash needed to get through economic cycles and set the stage for success.

Smart Accounts Payable Strategies and Liquidity Boosting

From my experience, managing what you owe is more than just paying off debts. It involves intelligent steps that increase your business’s cash availability and stability. Here are the main strategies:

- Plan and analyze costs well to ensure debts are paid without hurting financial stability.

- Intelligent handling of what you owe helps keep cash available.

- Having cash on hand is vital for planning and making wise choices.

With these strategies ready, we can look closer at how forecasting and billing play critical roles in keeping a good cash flow.

Smart Forecasting Methods for Small Business

Based on what I’ve learned, the mainstay of small business financial success lies in solid cash flow management, especially through smart forecasting. Forecasting is more than just a financial term. It is a strategic method that can greatly affect your financial choices and budget planning.

The top methods for ensuring financial success in small businesses involve being proactive with cash flow forecasts. By predicting future cash coming in and going out, you can make choices that fit your business’s financial aims. I’ve found that forecasting helps spot potential gaps or extra cash, letting you tweak your budget and spending as needed. This look-ahead approach makes sure you are never surprised by financial hitches.

A critical part of forecasting that I can’t highlight enough is the need for prompt billing. It is a crucial piece that directly affects your cash flow. Slow billing can create a lag between provided services and received cash, blocking your business’s cash flow. So, I suggest a strict billing system that ensures bills are sent out right after services are given or goods are sold. This habit secures a steady cash flow and supports your business’s financial stability.

With a strict approach to forecasting and billing, we are set for a more in-depth look at how on-time billing and clear payment conditions can further strengthen our financial base.

Prompt Billing and Payment Conditions

Based on my experience, slow billing can seriously affect cash flow, creating a delay between delivering services or goods and getting paid. To push for quick cash inflow, I recommend setting late payment penalties. This move discourages clients from stalling payments and ensures they put your bill first. Together with on-time billing, It is vital to review your business performance regularly. These reviews help find areas to improve, supporting a positive cash flow cycle and better planning for growth and stability.

Business Reviews for Better Cash Flow

From what I’ve seen, regular checks on how your business is doing are a central part of intelligent money handling, especially for improving cash flow. We can gain a lot by taking a closer look at our company’s financial doings. This gives us a clearer view of our economic state and helps us find areas to work on that could bring in more money.

One of the main benefits of these checks is the chance to closely watch your costs. Minor oversights can cause significant problems, and in business, these can often be found in unchecked regular costs or investments that are not paying off.

To wrap up, having separate accounts for each can greatly simplify cash flow management, precisely tracking our finances. This split helps with current money management and getting ready for future cash flow needs.

In short, regular checks on how your business is doing are a priceless tool for small business owners, offering ways to improve financially and a better grasp of the company’s money direction.

Keeping Personal and Business Money Separate for Clear Tracking

From my experience, having different accounts for personal and business money is an essential step for explicit financial tracking. This separation is critical for making intelligent choices and understanding our business’s economic state. It makes forecasting and preparing for coming financial duties easier, ensuring the company stays on firm financial ground. With a clear line between personal and business money, we can make the most of modern economic tools.

Read More: KredX – Enabling Streamlined Cash Flow for Businesses

Using Tech to Handle Small Business Cash Flow

Pulling from past insights, It is clear that using advanced methods like intelligent software is necessary for small businesses that want to do well. Moreover, tech also helps with budgeting and predicting cash flow. I believe bringing tech into small business cash flow management helps with inventory and cutting costs. Looking ahead, It is evident that using tech smartly for cash flow management is not just about keeping your finances straight. It is about giving small businesses the tools to make wiser, more forward-looking financial choices.

Inventory and Cost Cutting Methods

I’ve seen that handling inventory well is a central part of good cash flow management for small businesses. I know that by fine-tuning inventory, we can free up cash that might be stuck in too much stock. This means spotting goods that are not selling fast and might be blocking cash flow. It is wise to offer these slow sellers a discount to bring in money, which can go into more popular products.

I also believe that finding and stopping unnecessary costs is crucial. Trust me, every dollar saved in costs is a dollar that can help your business’s financial state. By thoroughly checking your business spending, you can find areas where money might be wasted and shift those funds to more valuable areas. This not only improves cash flow but also makes sure your business runs smoothly.

With a sharp eye on inventory and cost cutting, we are more ready to deal with financial challenges, keeping our business strong in uncertain times.

Planning Finances and Emergency Cash Reserves

From my experience, financial planning is a complex task that needs to focus on several key parts to keep cash flow stable. These parts include:

- Smart payment planning is key for a good cash flow.

- Having an emergency cash fund is vital for unexpected financial issues.

- Merging financial services and software can make these tasks easier.

Using these financial planning parts gives businesses the toughness to deal with sudden financial problems, laying the groundwork for a chat on the efficiency of financial services and software.

Financial Services and Software for Better Cash Flow

From what I’ve seen, financial services and software for cash flow management software offer many a clear view of where your money comes from and goes, which is crucial for making intelligent choices. These tools make tracking money simpler and automate tasks like billing and budgeting, saving time and lowering mistakes. With these systems ready, we are now set to see how to put all these methods into practice for the health and growth of our business.

Conclusion: Practical Steps for Cash Flow Handling

In my journey, I’ve seen that managing cash flow is the key to a thriving small business. We have examined many methods to significantly boost your company’s financial state. As small business owners and money managers, I urge you to use these methods for economic success. Consider the tactics we discussed, check your current practices, and see how you can bring these changes to life for a stronger financial future. Your work in small business cash flow management today will set the stage for a more secure and flourishing tomorrow for your business.

Whether it is financial fraud or illegal practices, Trade Finance Advice provides expert advice. Visit https://www.tradefinanceadvice.com/ to learn expert advice on issues faced by trade finance organizations.